Having an insurance policy for your rental property helps offset the costs to repair damage from accidents, vandalism, or natural disasters. But once the insurance company has processed your claim, how do you account for the insurance payment? The bookkeeping entries required to record the funds depend on whether your claim was related to an asset or general damages. We’ll look at both scenarios and walk you through the best practices for recording an insurance claim payment.

Payments Related to General Damages

Let’s say that water came through a vent in the roof of your rental property during a storm. The water caused $15,000 of damage to the insulation in the attic, drywall, carpet, and carpet pad. Your insurance company sends you a check for $10,000, and you start working on the repairs. How do you record those expenses and the insurance payout?

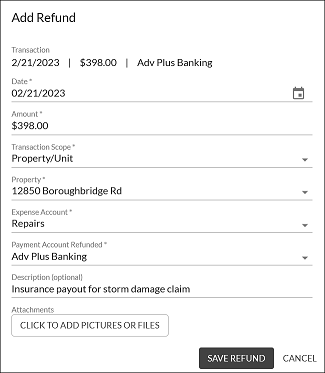

Bookkeeping for an insurance payment for a claim not related to a fixed asset is straightforward. Record the repair expenses as you normally would. And once you deposit the insurance check, instead of crediting an income account, credit the repair expense account. In REI Hub, you can easily do this with the ‘Refund Received’ transaction type:

When you run your P & L reports, the total shown for your repairs account will be the net total of all the repair expenses and the insurance payment.

Payments Related to Fixed Assets

For this example, let’s say the HVAC unit at your rental property was damaged during a flood. You filed a claim with your insurance company, and now you’ve received a check so you can replace the unit.

The original HVAC unit cost $10,000 when you bought it five years ago. Your HVAC unit was treated as an asset, and you’ve recorded the depreciation for it over the last five years. The IRS considers an HVAC unit (not window AC units) as part of the structure, so it was depreciated over 27.5 years.

Use REI Hub’s Fixed Asset Schedule to see the book value and depreciation for your asset. In this case, the remaining book value of the old HVAC unit is $8,181.80. Since your unit wasn’t fully depreciated when it was damaged, the check from the insurance company can’t count as profits. You’ll need to remove the asset from service and the account books.

Removing a Fixed Asset from the Books

If you haven’t disposed of an asset before, you’ll need to create a new account in your chart of accounts. It’s an asset account; just title it Asset Disposal and select Fixed Asset in the Account Subtype line.

To remove the original HVAC unit from the books, navigate to the Fixed Asset section of your REI Hub account. Select the unit from your list of assets, then click Add Transaction. Choose the Manual Journal option. Next, add the transaction date and a brief description in the appropriate fields. Debit the remaining book value to the Asset Disposal account. Credit the remaining book value to the original HVAC unit asset account. Now the damaged unit is no longer on your books.

Accounting for the Insurance Payment

Once you’ve deposited the insurance check in your bank account, you’ll need to record it as a refund on your books. Click the Add Transaction button in your REI Hub account, then select Refund Received. Choose Asset Disposal as the expense account, and in the Payment Account Refunded field, select the account where you deposited the check.

When you look at the balance in your Asset Disposal account, that amount is your profit or loss. If the insurance company paid out more than remaining value of your HVAC unit, you’ll have a profit. If you received less than the book value, you’ll have a loss. For this example, our insurance company sent a check for $9,000, so we have a profit of $818.20.

If this is the first time you’ve received a payment for an insurance claim, you must create a new account in your chart of accounts. If your Asset Disposal account has a profit in it, create a new revenue account called Gain from Insurance Claim. If your Asset Disposal account has a loss in it, create a new expense account, Loss from Insurance Claim.

To zero out the Asset Disposal account and move the profit/loss to the proper account, create a manual journal transaction. Credit the Gain from Insurance Claim account by $818.20, and debit the Asset Disposal account by the same amount.

Recording Additional Asset Disposal Income

Just because an asset is out of service, that doesn’t mean it’s worthless. See if you can sell parts or take the asset to a salvage or scrap yard. Let’s say we got $200 for taking the old HVAC unit to the salvage yard. To record the funds, click Add Transaction in your REI Hub account, then select Manual Journal. Add the transaction date and related details. Credit the Asset Disposal account by $200, and debit the bank account by $200.

Next, we need to zero out the Asset Disposal account again. Create a manual journal transaction. Credit the Gain from Insurance Claim account by $200, and debit the Asset Disposal account by the same amount. Your reports now reflect your updated asset list and the correct account for the profits/losses related to the insurance claim.

Recording insurance payments for damaged assets requires attention to detail and a few extra steps, but by following these best practices, you’ll remove old assets from your books, determine the profit or loss received from the insurance company, and properly record any additional funds related to asset disposal.

Conclusion

Dealing with rental property damage and insurance claims can be a hassle. Accounting for your insurance payout shouldn’t be. Using REIHub’s templates and step-by-step instructions makes the bookkeeping process manageable. Following these accounting best practices will ensure that your insurance payments are recorded correctly, your asset accounts are accurate, and your reports reflect the transactions in the proper accounts.