Features

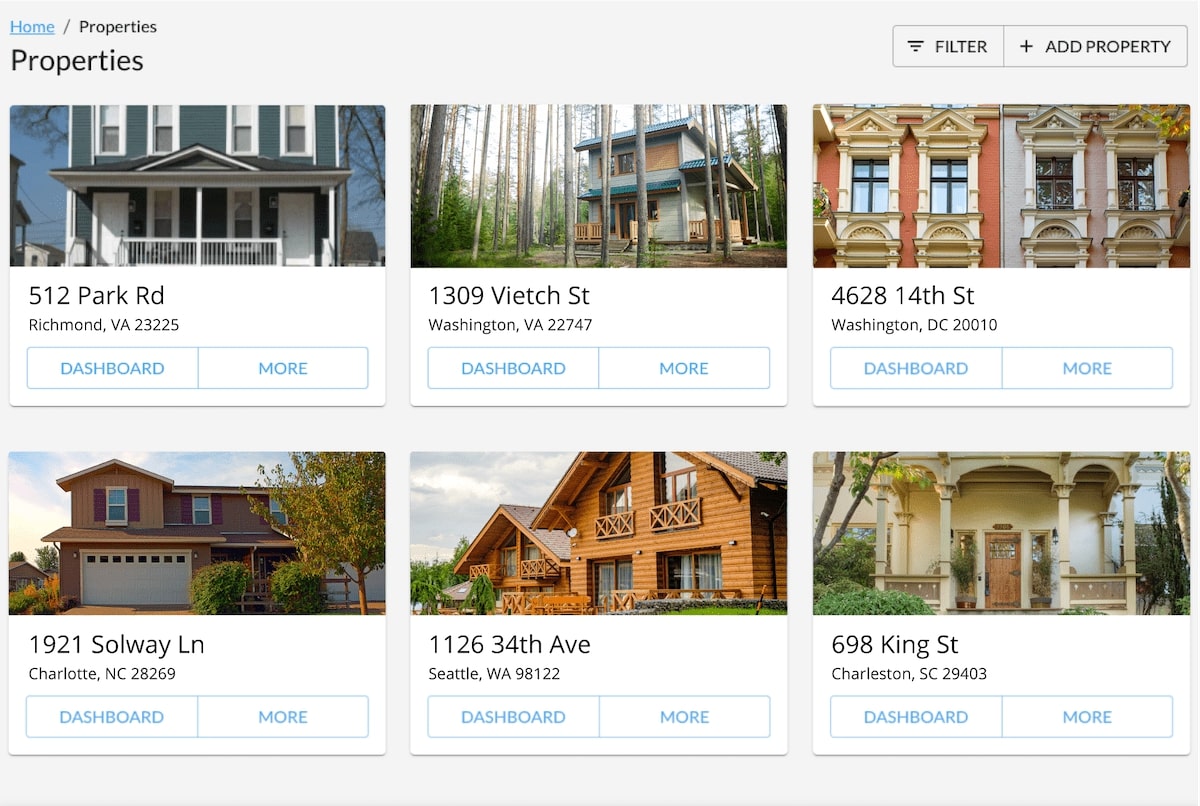

Properties

Business-class accounting and bookkeeping in the language of real estate.

Property Centric

Preconfigured for Real Estate Investments

Don’t worry about setting up your accounting software and chart of accounts—we’ve already done that for you! By default, REI Hub is configured for easy IRS Schedule E reporting.

Rental Specific Transactions

Not sure how a security deposit should be recorded? REI Hub includes preset rental transaction templates to help you get it right!

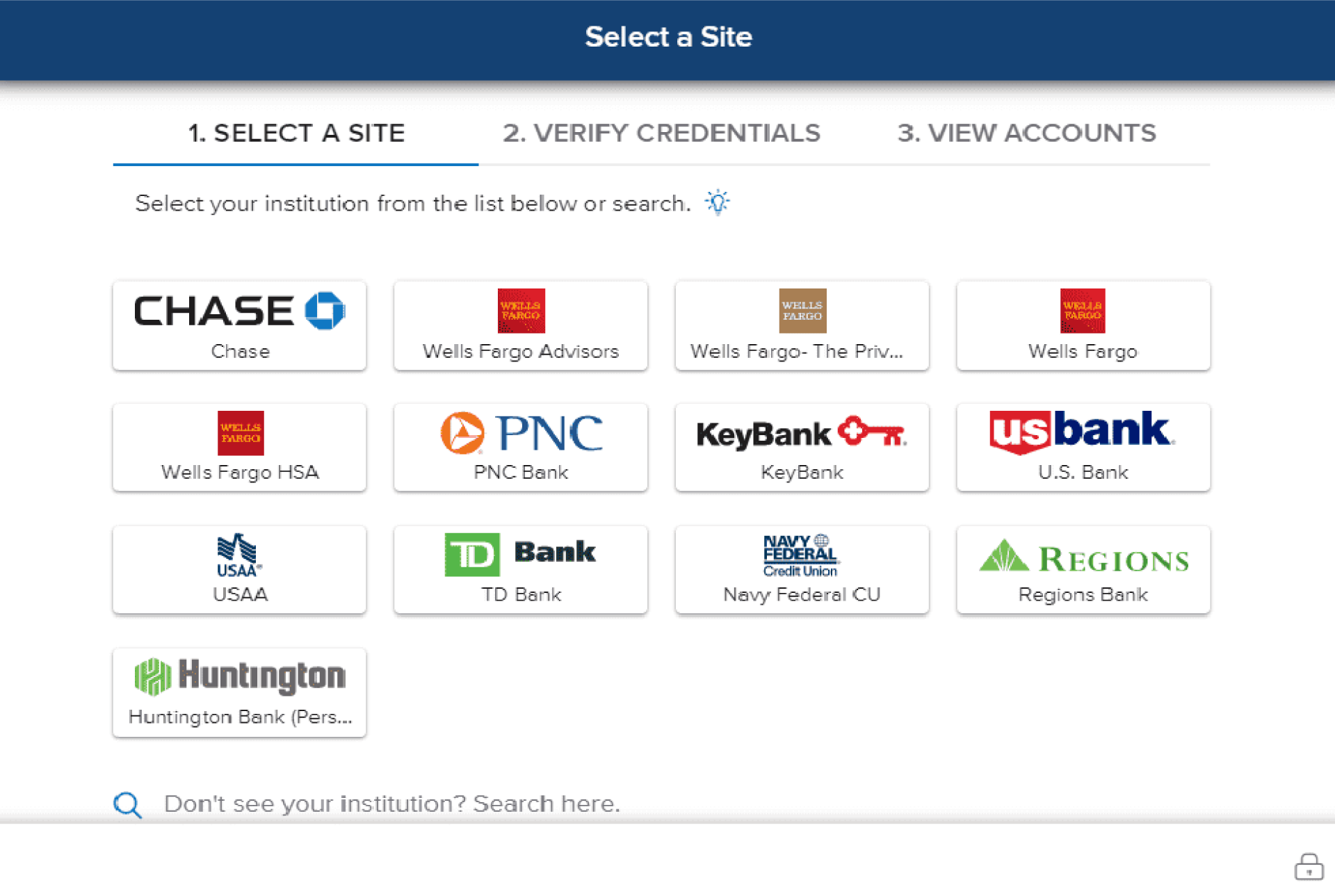

Accounts

Simple & Safe Account Link

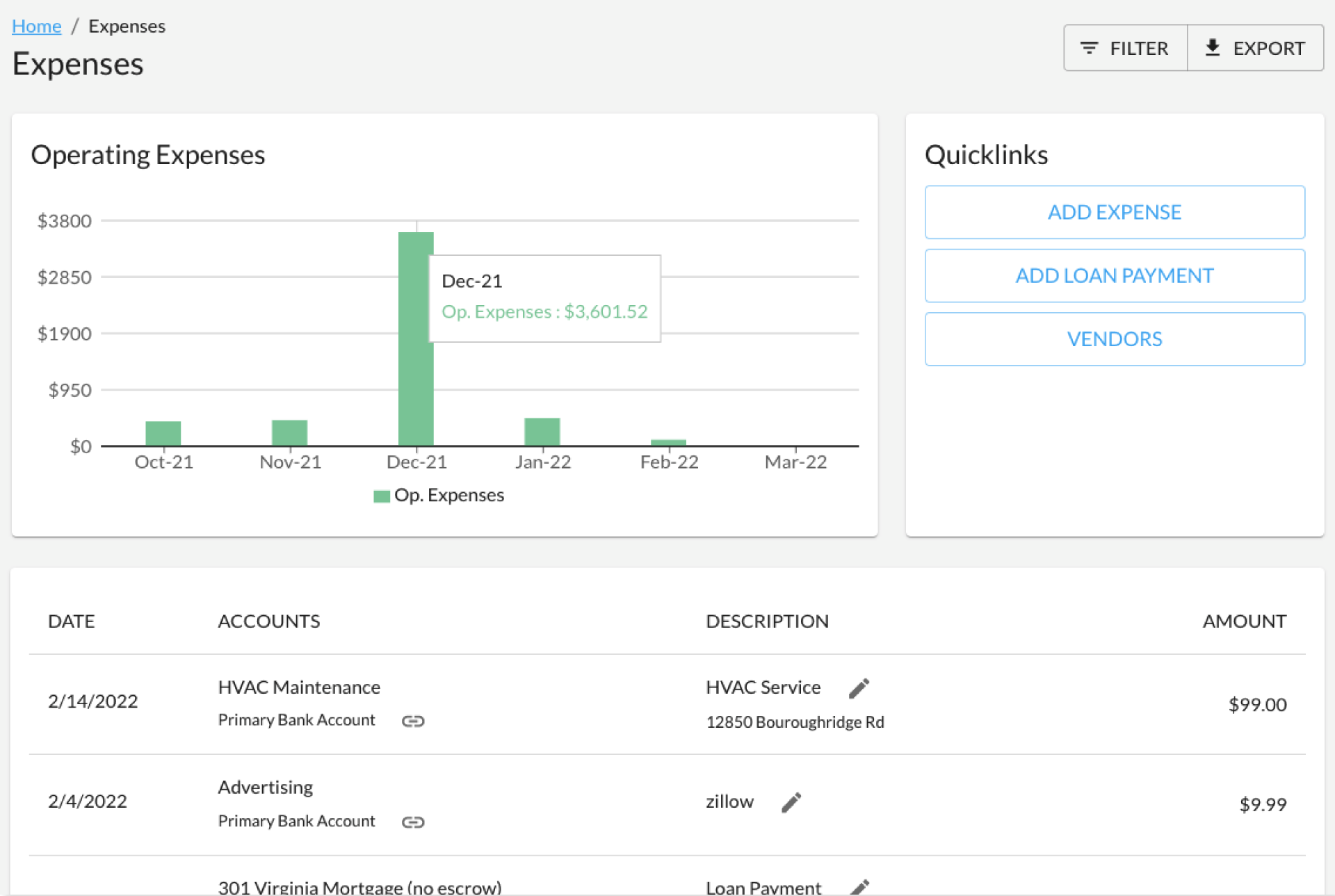

Rules & Recurring Transactions

Automated Mortgage Accounting

REI Hub lets you set up a template for your mortgage payment, automatically splitting it into principle pay down, interest expense, and escrow contribution.

Bookkeeping

Attach receipts, log your mileage, and keep key documents safe with REI Hub’s integrated organizational suite.

Lease Tracking

Stay ahead of your expiring leases—use REI Hub to help you track tenants, dates, and lease terms.

Mileage Log

Do you travel to manage or maintain your rental properties? If so, you may be eligible to deduct eligible travel expenses. Keep track with REI Hub’s mileage log, which feeds directly into your Schedule E.

Receipt & Document Storage

Keep your records safe in the cloud. Attach any file to any transaction with our easy to use upload tool. You can even use your computer webcam to take pictures of receipts and directly attach to expenses!

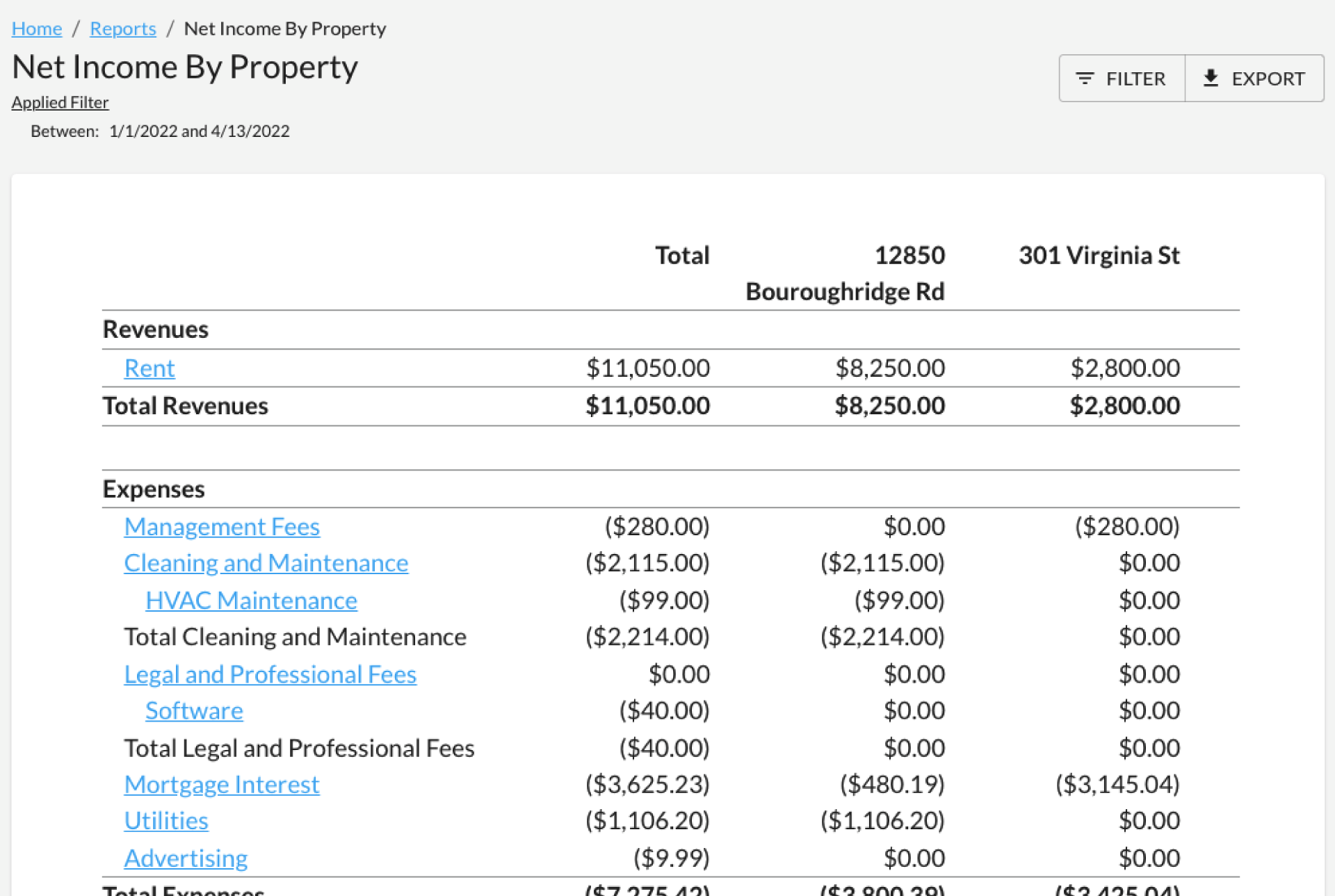

Reports

Access both full financial reports as well as tax ready IRS Schedule E reports.

Comprehensive Financial Reporting

Easily access all 3 major accounting reports—the Profit and Loss (available for portfolio, property, or unit), the Statement of Cash Flows, and the Balance Sheet (available for your Portfolio)

Your Schedule E, Ready To Go

REI Hub allows you to easily pull a Schedule E report for each property with no additional configuration. You can even prorate overhead expenses across your entire portfolio!

Fixed Asset Tracking

Real estate investors know how important depreciation deductions are to their tax bills. REI Hub allows you to track your Fixed Assets (including capital expenses) and accumulated depreciation.